The Paycheck Protection Program (PPP) has been a lifeline for many businesses during the pandemic, but with great benefits come great responsibilities. As the government has disbursed billions of dollars to assist struggling companies, questions have arisen about the integrity of those who received funds. One such question that has garnered attention is, is there a PPP warrant list? This inquiry delves deep into the legality and ethics surrounding the PPP, as well as the potential consequences for those who may have misused the funds.

Understanding the ramifications of the PPP is crucial for both businesses and the general public. The program was designed to provide forgivable loans to help small businesses keep their workforce employed during the COVID-19 crisis. However, as with any government program, there have been instances of fraud and abuse. This has led to investigations and, in some cases, warrants being issued for those suspected of wrongdoing. Thus, the question arises: is there a PPP warrant list that the public can access to identify these individuals?

This article aims to shed light on the intricacies of the PPP, explore the existence of a warrant list, and provide insights into how this impacts both businesses and individuals involved. Additionally, we will examine the consequences of misusing PPP funds and what potential offenders might face in terms of legal action. The answers to these questions are not only important for those who participated in the PPP but also for taxpayers who funded this initiative and want to ensure accountability.

What is the Paycheck Protection Program (PPP)?

The Paycheck Protection Program was established by the U.S. government in response to the COVID-19 pandemic. The goal was to help small businesses maintain their workforce and manage operational costs during an unprecedented economic downturn. Here are some key features of the PPP:

- Loans were offered to small businesses with the potential for full forgiveness if certain criteria were met.

- Funds could be used for payroll, rent, mortgage interest, and utilities.

- Eligibility was primarily based on the number of employees and the business's financial health prior to the pandemic.

- The program was administered by the Small Business Administration (SBA) in partnership with various lenders.

Is There a PPP Warrant List Available to the Public?

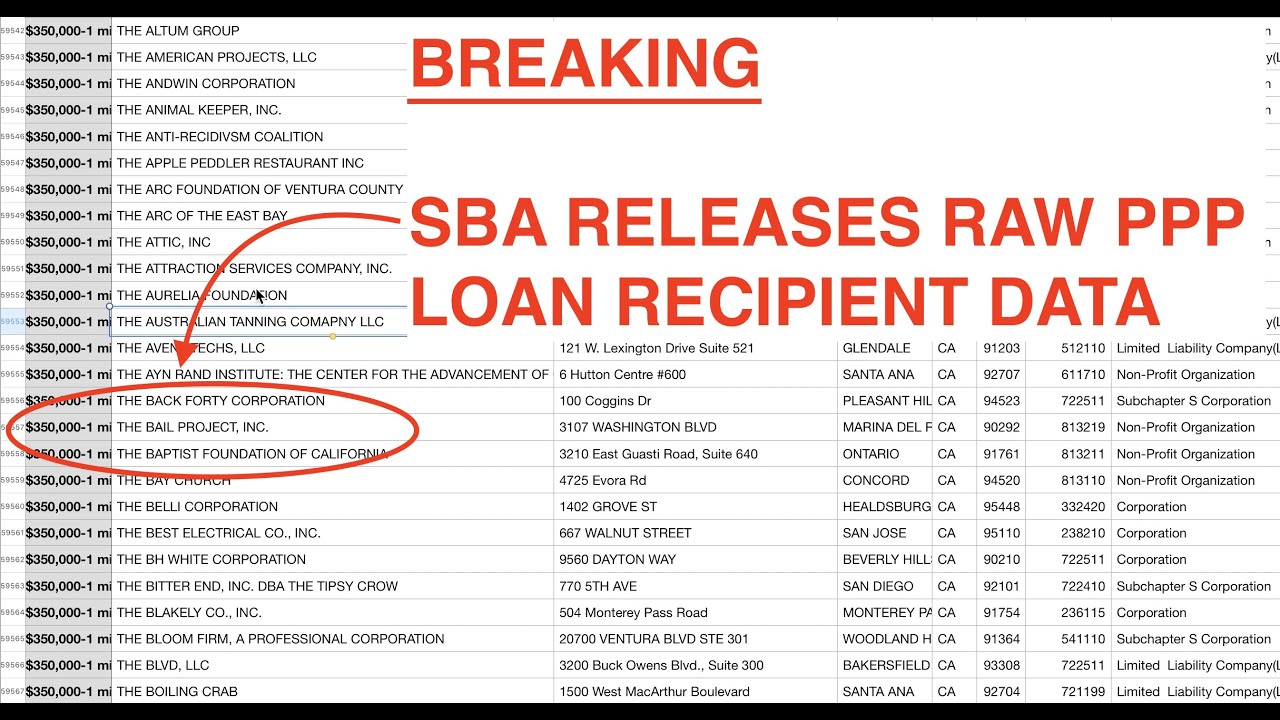

One of the pressing questions surrounding the PPP is whether there exists a public warrant list for those suspected of fraudulently obtaining funds. While some government agencies maintain records of criminal activity, the specific availability of a PPP warrant list is not straightforward. The information may be part of broader investigations and not easily accessible to the public.

How Can You Find Information About PPP Fraud Cases?

To understand whether someone is implicated in PPP fraud, you can follow these steps:

- Check local news outlets for reports on PPP-related investigations.

- Visit the official websites of the SBA or the U.S. Department of Justice for updates on fraud cases.

- Utilize search engines to find specific names associated with PPP fraud allegations.

- Consult legal databases if you have access to them for more in-depth information.

What Happens to Those Accused of PPP Fraud?

The consequences of PPP fraud can be severe, ranging from financial penalties to criminal charges. Here are some potential outcomes:

- Investigations by federal and state authorities.

- Restitution payments to recover misused funds.

- Criminal charges that could result in imprisonment.

- Loss of eligibility for future government assistance programs.

Who is Most Likely to Face PPP Fraud Charges?

While anyone can potentially commit fraud, certain groups are more susceptible to facing charges. These include:

- Business owners who falsified information on their loan applications.

- Individuals who used funds for non-qualified expenses.

- Those who applied for multiple loans under different business names.

Is There a Way to Report Suspected PPP Fraud?

If you suspect someone of committing PPP fraud, you can report it through the following channels:

- Contact the Small Business Administration (SBA) Office of Inspector General.

- File a complaint with the Federal Bureau of Investigation (FBI).

- Utilize the Department of Justice’s fraud reporting hotline.

Consequences of PPP Fraud on the Larger Economy?

The implications of PPP fraud extend beyond the individuals involved. The misuse of funds can have a ripple effect on the economy, including:

- Increased scrutiny and regulations on future programs.

- Loss of trust among the public in government assistance initiatives.

- Potential financial losses that could affect taxpayers.

What Can Businesses Do to Protect Themselves from PPP Fraud Allegations?

Businesses can take proactive measures to safeguard themselves against PPP fraud allegations, such as:

- Maintaining accurate and transparent financial records.

- Consulting with financial advisors before applying for loans.

- Understanding the terms and requirements of the PPP thoroughly.

Final Thoughts on the Existence of a PPP Warrant List

In conclusion, while the question remains, is there a PPP warrant list?, the reality is that the information may not be fully available to the public. What is clear, however, is that the implications of PPP fraud are significant and far-reaching. Ensuring compliance with the program's guidelines is essential for businesses to avoid legal repercussions and maintain their reputation. As the government continues to investigate fraudulent claims, transparency and accountability should remain a priority for all stakeholders involved.