The Warrant PPP Loan List has emerged as a crucial resource for individuals and businesses seeking information about loans provided under the Paycheck Protection Program (PPP). These loans, designed to help businesses retain their workforce during the COVID-19 pandemic, have come with specific guidelines and requirements. The warrant PPP loan list serves as a comprehensive database that outlines those who received these loans and the status of their applications. As the economic landscape continues to evolve, understanding this list can help borrowers and stakeholders navigate the complexities of the PPP loan process. With the federal government implementing various measures to ensure transparency, the warrant PPP loan list provides a window into how these funds have been allocated and utilized.

In the wake of the pandemic, many businesses found themselves in dire need of financial assistance. The PPP was launched to provide forgivable loans to eligible small businesses, but not without its challenges. The warrant PPP loan list is not only a reflection of the amount disbursed but also a testament to the rigorous process of verifying eligibility and compliance with the program’s regulations. It has become a pivotal point of reference for understanding the impact of the PPP on various sectors.

As we delve deeper into the warrant PPP loan list, we will explore its significance, the implications of the loans, and how businesses can leverage this information for their benefit. Understanding the details surrounding these loans can empower borrowers to make informed decisions and ensure they are on the right path in managing their financial obligations.

What is the Warrant PPP Loan List?

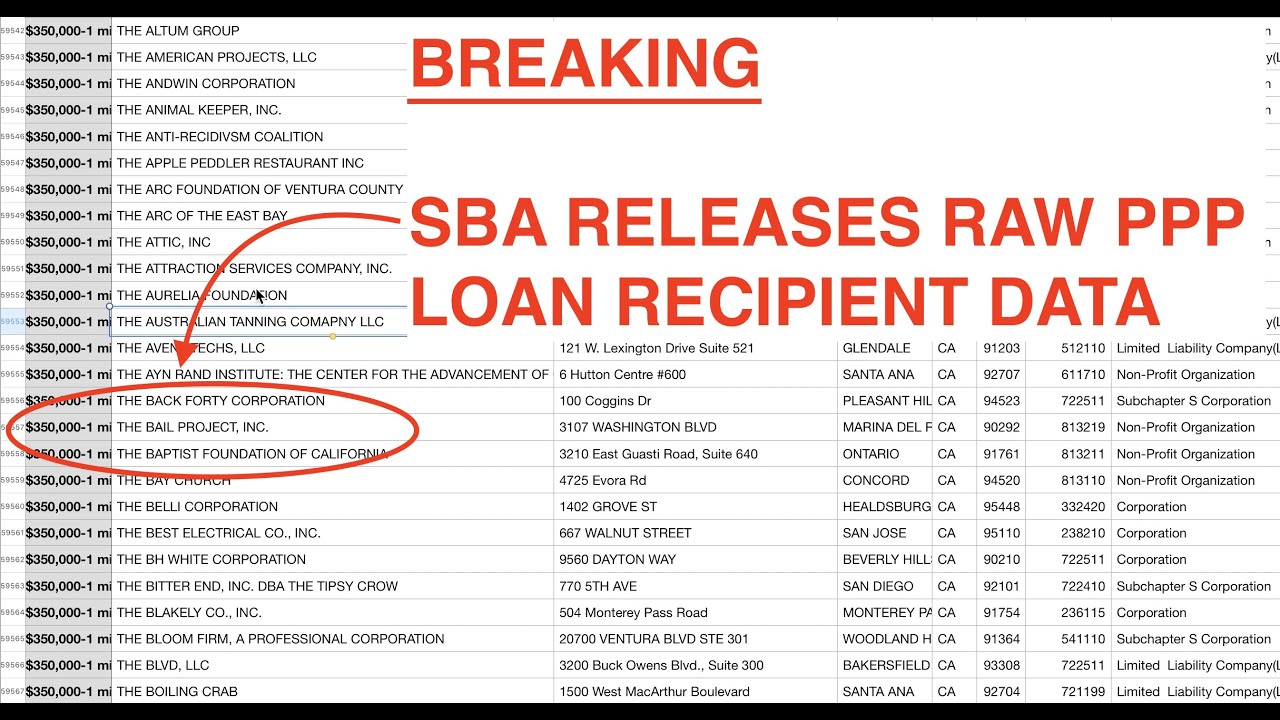

The warrant PPP loan list is a compilation of all loans issued under the Paycheck Protection Program, detailing the recipients and amounts received. This list has been made publicly accessible to promote transparency and accountability in how taxpayer money is allocated.

Why is the Warrant PPP Loan List Important?

The importance of the warrant PPP loan list cannot be overstated. It serves multiple purposes:

- **Transparency**: It allows the public to see how funds are distributed.

- **Accountability**: Businesses that received funds are held accountable for their use.

- **Research and Analysis**: Economists and researchers can analyze the data for trends and outcomes.

- **Public Awareness**: Informs stakeholders about financial assistance during the pandemic.

How Can You Access the Warrant PPP Loan List?

Accessing the warrant PPP loan list is straightforward. The U.S. Small Business Administration (SBA) has made this information available on its official website. Here’s how you can find it:

- Visit the SBA website.

- Navigate to the PPP section.

- Locate the loan data or public records section.

- Download or view the warrant PPP loan list.

Who is Eligible for PPP Loans?

To qualify for a PPP loan, businesses must meet specific eligibility criteria, which include:

- **Business Size**: Must be a small business as defined by the SBA.

- **Operational Status**: Must have been operational on or before February 15, 2020.

- **Employee Count**: Must have 500 or fewer employees.

- **Good Faith Certification**: Applicants must certify that the loan is necessary to support ongoing operations.

What Happens if a Business Misuses PPP Funds?

Misuse of PPP funds can lead to severe consequences. If a business is found to have utilized the funds for non-eligible expenses, they may face:

- **Loan Forgiveness Denial**: The business may be required to repay the loan in full.

- **Legal Action**: Misuse can lead to lawsuits or criminal charges.

- **Reputational Damage**: Companies may suffer from negative publicity.

What Should Businesses Do if They Are Listed on the Warrant PPP Loan List?

If a business is listed on the warrant PPP loan list, they should take the following steps:

- **Review Information**: Ensure that the details listed are accurate.

- **Maintain Records**: Keep thorough records of how the funds were used.

- **Consult with Professionals**: Seek advice from financial advisors or legal counsel if necessary.

Can Individuals Search for Specific Businesses on the Warrant PPP Loan List?

Yes, individuals can search for specific businesses within the warrant PPP loan list. The SBA’s database allows users to filter and search by various criteria including business name, loan amount, and location. This feature is particularly helpful for those looking to understand the financial landscape of their community or industry.

What Information is Included in the Warrant PPP Loan List?

The warrant PPP loan list includes important information such as:

- **Business Name**

- **Loan Amount**

- **Loan Status**

- **Date of Loan Approval**

- **SBA Office**

Is the Warrant PPP Loan List Updated Regularly?

Yes, the warrant PPP loan list is updated regularly to reflect new approvals, changes in status, and other relevant information. Keeping abreast of these updates can provide valuable insights for both borrowers and stakeholders.

Conclusion: Navigating the Warrant PPP Loan List

In summary, the warrant PPP loan list is an essential tool for understanding the distribution and impact of PPP loans across various sectors. By utilizing this resource, businesses can ensure compliance with the program’s guidelines and make informed financial decisions. As we continue to navigate the post-pandemic landscape, the transparency offered by the warrant PPP loan list will be crucial in rebuilding and sustaining our economy.